NOTE: This series is not intended as a replacement for obtaining the advice of a good contracts or business attorney. Although we understand that in many cases it simply isn’t cost effective for a small business to pay an attorney to review a contract, the following information shouldn’t be considered a replacement for obtaining that kind of advice. Also, keep in mind, that an attorney can typically review and identify issues with a contract without doing a detailed revision of the document for a reasonably affordable price (depending on the complexity of the contract, for as little as a few hundred dollars). Obtaining that kind of input in advance could save you a significant amount of money later if a dispute arises.

Question One: Who am I contracting with?

“Who am I contracting with?” is among the first questions I would ask when reviewing a contact. When dealing with small businesses and individuals, you will often encounter people doing business in their own name personally, but often these days we see people who have either incorporated or organized their own business entity and are doing business in that name. Sometimes it is not entirely clear. Individuals may give you a business name but they may not have taken the steps necessary to actually form a company by that name. Some businesses will have names that end in “Inc.” (indicating you’re probably doing business with a corporation) or “LLC” (indicating you’re probably doing business with a limited liability company). They may have given you a dba (doing business as) or they simply may have actually formed a business but neglected to give you the full name with the suffix. The form of business is less important than knowing the name and verifying that it is correct (but see the short note below regarding doing business with individuals versus business entities). If a dispute arises later, you want to avoid any question whether you contracted with the party you expected to be doing business with.

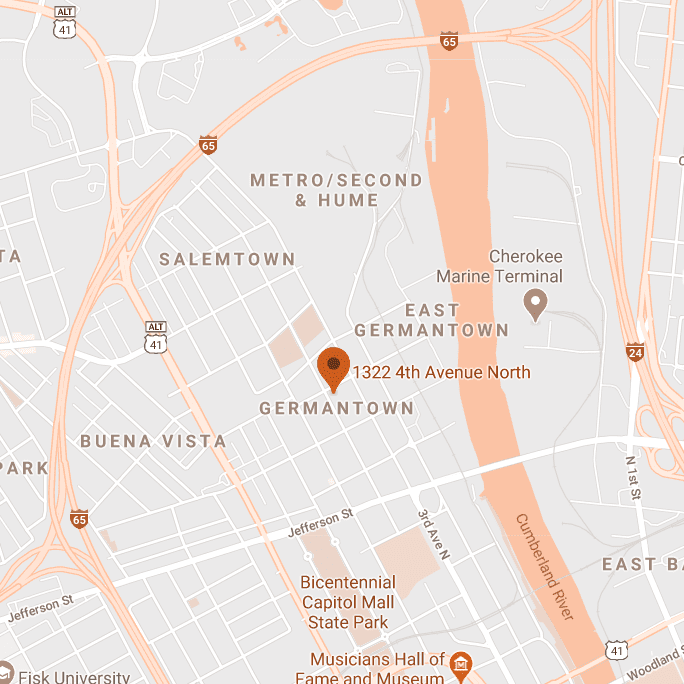

You can often verify a name you’ve been given by checking certain state-maintained informational websites. Corporations and limited liability companies, the two most popular business types used by small businesses, are formed by filing appropriate documents with a state body. In Tennessee, these documents are filed with the Secretary of State’s office, and you can verify the name of a company you may be considering doing business with (in Tennessee) is legitimate by searching on the Tennessee Secretary of State’s website. If you’re dealing with a company from another state, you may be able to locate information at that state’s Secretary of State’s website or other state business entity authority (if not on the Tennessee website above—out-of-state companies doing business in Tennessee are in some cases required to register with the TN Secretary of State). Searching google.com for “[state] business entity search” will usually identify the appropriate website for other states. If you can’t find the name of the business the other party has provided at such a website, you should ask the other party to confirm their legal name is correct. Bottom line: be sure the name they’ve given you to use in the contract is a business that actually exists.

Also keep in mind—if you’re dealing with a person who will be providing services directly (such as a consultant), and they give you a business name instead of their own name for the contract (which would not be unusual), this could limit your right to recover against the individual personally if something later goes wrong or they breach the contract. You may only be able to bring a claim against the business and not the individual (depending on the nature of the claims you have), and absent rare circumstances, only the business’s assets, and not those of the individual, will be available to satisfy your claims.

Finally, you should search the internet for any reviews or other information about the party you may be considering doing business with before signing a contract with them. In one matter I was involved in, a quick search on the name of an individual that my client was considering doing business with revealed the individual had been convicted in another state for various financial crimes, as well as a scam report by another party complaining of being defrauded by the individual (under circumstances eerily similar to the proposed business transaction my client was considering). More detailed background searches can be obtained for a fee if the situation warrants it. In one instance, a quick, free search saved thousands in legal costs negotiating a contract (and potentially hundreds of thousands in exposure, had the deal actually gone through and my client been defrauded).

Check back soon for Volume II, when we will discuss contract term, termination, and renewal.

*Photo Credit: Foter.com

The information contained on this blog is not legal advice, nor does this blog create an attorney-client relationship. Klein Bussell attorneys do not blog about pending matters handled on behalf of our clients and will never disclose client confidences.

The information contained in this blog does not constitute legal advice, nor does this blog create an attorney-client relationship. KSM attorneys do not blog about pending matters handled on behalf of our clients and will never disclose client confidences.